8th Pay Commission in India: UPSC Notes on Objectives, Structure & NPS vs OPS

Understand the 8th Pay Commission: objectives, structure, expected salary hike, and NPS vs

OPS comparison. UPSC-ready notes with latest updates for 2025–26.

If you’re a UPSC aspirant, government employee, or simply someone who follows India’s

economic and administrative developments, the 8th Pay Commission is a topic you need to

keep an eye on. Salary revisions, pension reforms, allowances, fitment factors—this one

decision impacts over 1 crore people, directly and indirectly.

In this article, we break down everything you need to know in a simple, clear, conversational

way—perfect for UPSC notes and general understanding.

Introduction

Pay Commissions have been part of India’s administrative system since independence. Whenever inflation rises or salaries need restructuring, the government forms a commission to revise pay scales, allowances, and pensions for central government employees.

The 7th Pay Commission took effect in 2016. Now, with nearly a decade gone, discussions around the 8th Pay Commission (8th CPC) are in full swing.

But what exactly will it do? What are its objectives? And why is the NPS vs OPS debate linked to it?

Let’s decode it step-by-step.

What is the 8th Pay Commission?

The 8th Pay Commission is expected to be the next central commission set up to revise salaries, allowances, and pensions for central government employees and pensioners.

While the official announcement is still awaited, strong indications, media reports, and union demands suggest it will roll out around 2025–2026.

Why now?

- Inflation is high

- Allowances need restructuring

- NPS-related concerns are rising

- Government staff expect compensation adjustments after 10 years

The conversation is already trending because government employees are anticipating clarity on fitment factor, minimum salary, DA structure, and pension benefits

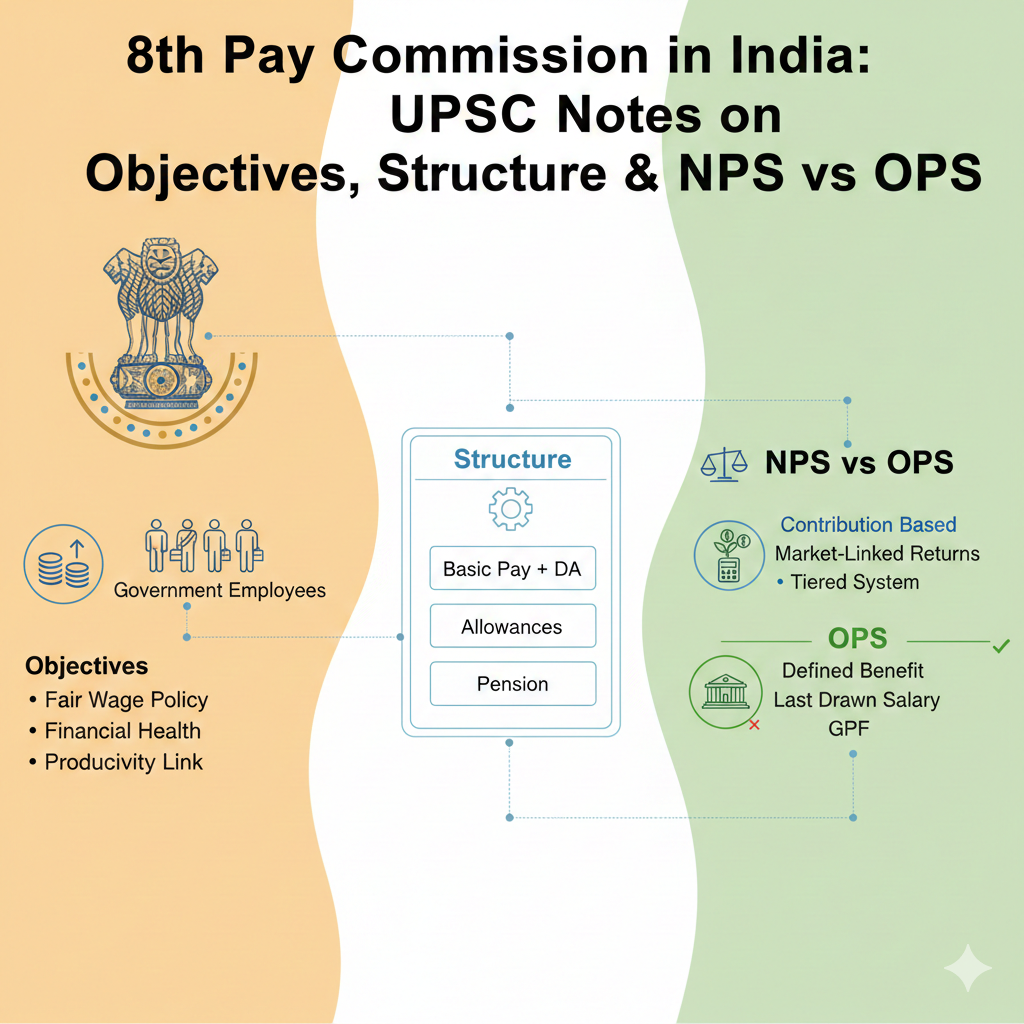

Objectives of the 8th Pay Commission

Unlike popular belief, Pay Commissions don’t just increase salaries. Their objectives are much broader and tied to India’s economic health and administrative efficiency.

Key Objectives

- Ensure fair and updated pay structures

- Maintain parity across departments

- Adjust wages for inflation

- Reduce pay anomalies between junior and senior employees

- Improve morale, motivation, and retention in government services

UPSC-relevant objectives

- Improving governance through better compensation

- Reducing corruption by ensuring competitive salaries

- Aligning public sector pay with private sector benchmarks

- Advising the government on fiscal sustainability

Simply put, the 8th CPC aims to bring balance between employee welfare and financial responsibility.

Composition / Structure of the 8th Pay Commission

Every Pay Commission has a set of members who bring expertise in economics, finance, administration, governance, and labour issues. While the committee isn’t officially formed yet, a typical structure includes:

Likely Composition

- Chairman (Retired Supreme Court judge / senior bureaucrat)

- Finance Ministry

- Department of Personnel & Training

- Economic advisors

- Public administration experts

- Pension and pay matrix specialists

Terms of Reference (ToR)

The government usually assigns these:

- Review the pay matrix

- Examine existing allowances

- Recommend pension reforms

- Suggest pay parity if required

- Evaluate inflation and DA formulas

- Study NPS and propose improvements

- Review minimum & maximum pay levels

For UPSC aspirants, this part is crucial because it links directly to public administration, economy, and governance.

Expected Key Recommendations of the 8th CPC

Though the final report will take time, experts and unions expect the 8th Pay Commission to focus on:

1. Fitment Factor Increase

Expected range: 2.86 to 3.00+ This directly impacts basic pay, resulting in a noticeable salary jump.

2. Minimum Pay Revision

The current ₹18,000 (7th CPC) may rise significantly.

3. Allowance Revisions

- HRA

- TA

- DA revision cycle

- Hard area allowances

- Transport & special duty allowances

4. Pension Reforms

Especially important due to NPS-related dissatisfaction.

5. Pay Anomaly Corrections

Particularly for entry-level employees and pensioners.

8th Pay Commission vs 7th Pay Commission

A quick comparison helps understand what’s likely to change:

| Feature | 7th CPC | Expected in 8th CPC |

|---|---|---|

| Fitment Factor | 2.57 | 2.86–3.00+ |

| Minimum Pay | ₹18,000 | Expected increase |

| Pension System | NPS for new employees | OPS/NPS reforms |

| DA Frequency | Half-yearly | Likely same, but better formula |

| Allowances | Updated in 2016 | Further rationalization |

The 8th CPC is expected to be more employee-centric, especially with rising costs of living.

NPS vs OPS vs UPS: The Big Pension Debate

This is the hottest part of the discussion.

⭐ What is NPS?

A market-linked pension system where:

- Employees contribute 10% of their salary

- Government contributes 14%

- Pension depends on market returns

Employees feel:

- Pension is unpredictable

- No guaranteed DA-linked monthly pension

⭐ What is OPS? (Old Pension Scheme)

Before 2004, government employees enjoyed:

- Guaranteed lifelong pension

- 50% of last basic pay

- DA-linked hikes

- No contribution by employees

Naturally, many want OPS back.

⭐ Enter UPS: Unified Pension Scheme

A hybrid model being discussed:

- Combines features of OPS + NPS

- Offers guaranteed pension minimum

- Provides partial market-linked benefits

The 8th Pay Commission may play a major role in shaping this reform.

Expected Fitment Factor & Salary Hike

One of the most talked-about elements is the fitment factor.

Why? Because it decides the basic salary.

Fitment Factor Example:

If someone’s Basic Pay = ₹40,000

Under 3.00 fitment, new pay becomes: ₹1,20,000

(This is just indicative)

Government employees could see:

- 30–35% increase in basic pay

- Higher allowances

- Better pension benefits (post-reform)

Impact of the 8th Pay Commission

⭐ Impact on Employees

- Better financial stability

- Improved pensions

- Higher allowances

- Clarity on NPS reforms

⭐ Impact on Government Finances

- Heavy fiscal burden

- Budget adjustments required

- Pressure on FRBM thresholds

⭐ Impact on the Indian Economy

- Increase in demand/consumption

- Short-term inflationary pressure

- Boost in saving and investment

- Higher household spending

Pay Commissions usually create a consumption wave, boosting India’s economy.

Latest News & Updates (2025–2026)

Current discussions suggest:

- Government may set it up before Budget 2026

- Employee unions pushing for OPS restoration

- Fitment factor debates ongoing

- Pension reforms being evaluated under UPS

Since this is dynamic, UPSC aspirants should track:

- PIB releases

- Finance Ministry announcements

- Pre-budget economic reports

Why the 8th Pay Commission Is Important for UPSC

For UPSC students, this topic touches multiple subjects:

📌 GS2 – Governance

- Role of Pay Commissions

- Administrative reforms

- Centre–employee relations

📌 GS3 – Economy

- Impact on fiscal deficit

- Budgetary implications

- Pension reforms

- Inflationary effects

📌 Essay Paper

- Social security

- Government employee welfare

- Public administration efficiency

Conclusion

The 8th Pay Commission is not just about salary increases—it’s a major administrative and economic reform. It influences government employees, affects India’s fiscal policy, and is tied to one of the most contentious debates in recent years: NPS vs OPS.

For UPSC aspirants, understanding the objectives, structure, and implications of the 8th CPC ensures you’re ready for prelims, mains, and even interview questions.

Stay updated, keep revising, and track the latest announcements—because this topic will continue evolving.

FAQs

1. When will the 8th Pay Commission be implemented?

Likely around 2026, though no official announcement yet.

2. What is the expected fitment factor?

Experts expect 2.86 to 3.00+.

3. Will OPS be restored?

Still debated; UPS (Unified Pension Scheme) is being considered.

4. What changes are expected for pensioners?

Better formulas and possibly partial guaranteed pension.

5. How is the 8th CPC different from the 7th CPC?

Higher fitment factor, revised allowances, pension reforms, and updated pay matrix.

6. Why is this important for UPSC?

It covers governance, economy, fiscal policy, and administrative reforms.